Cash Management Solutions to Help Optimise Working Capital

Gain real-time visibility over your global cash position across different accounts, countries and entities. Centralise control of your global banking operations and benefit from cash analytics to optimise your working capital.

We’re proud to work with

How can we help?

Consolidate global banking operations

Replace periodic reporting with centralized visibility and control over your cash at group level. Learn more >

Unlock real-time cash analytics

Access real-time balances and transaction data from across your banking estate as soon as its available.

Improve auditability of transactions and balances

Simplify auditing and reporting with access to a fully searchable transaction database and drill-down analytics.

Get total control over your cash position

Ditch the spreadsheets and say goodbye to logging in to online banking portals.

AccessPay consolidates cash visibility across all of your banks, accounts, countries and currencies in real-time. By connecting your banking estate, data can be fed directly in to relevant finance applications (ERP, TMS, Reconciliation tool) or viewed within AccessPay’s own Cash Management Application, giving you ultimate over your cash via:

- Real-time reporting and analytics across all connected accounts utilizing intra-day and end-of-day statement messages (MTs)

- Aide daily cash forecasting by comparing your expected cash position to your actuals.

- Improve auditability with access to a searchable database of transaction logs across across all connected accounts

Optimise your cash with access to real-time data

Spend less time collating data and more time analysing it. AccessPay does the legwork to enable your team to get back to doing what they do best – making informed decisions with your cash.

Access your entire cash portfolio at the click of a button to stay one step ahead of expenditure, debt repayment and investment opportunities:

- Unlock hidden cash across different entities, countries, currencies and banks

- Drill down in to real-time balances and transaction data to support Treasury and reconciliation activities

- Quickly identify potential risks like overdrawn accounts, large cash inflows/outflows late movements and peak liquidity usage using custom alerts

Move data in minutes, not hours

Want access to the most timely, accurate transaction data? Why wait? Get statements into your back-office as quickly as you can receive them from the bank.

AccessPay enables straight-through processing of statements by automating the download and transformation of data in to whatever format you. Cutting processing times from hours to minutes in comparison to more manual methods like online banking.

When it comes to connecting your banking network, a number of options are available:

- Using your own SWIFT BIC – the preferred option for corporates with an existing connection to SWIFT

- Using AccessPay’s BIC – preferred by corporates who are not connected to SWIFT

- Using a host-to-host connection

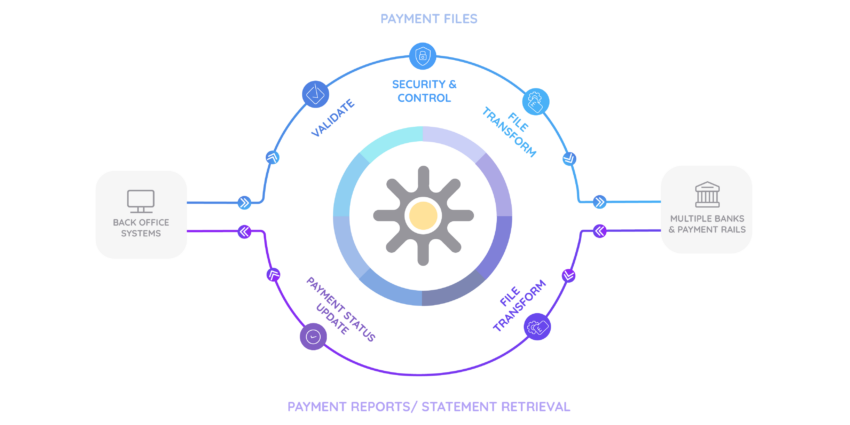

How does it work?

Whether it’s end of day or intra-day statements over the SWIFT network, a direct connection to your bank, or even through open banking, we offer a number of options when it comes to integrating with your corporate banking partners.

SWIFT MTs

- We’re able to instruct any bank to deliver MT940 (end of day) and MT942 (intra-day) statement messages

- This method outputs a standardised bank statement format

- Statements retrieved by AccessPay platform and ‘piped’ back into your TMS or ERP application via a secure sftp client.

- Receipt of MT messages is chargeable by your bank

- Track the progress of inbound payments with SWIFT GPI

Open Banking API

- Self-service set-up takes just a few minutes

- Outputs transaction and balance data

- AccessPay file transformation engine available to automate file formatting for onward reconciliation

- Accesspay connects to the Open Banking API as a 3rd party

AccessPay is really easy to use and it’s really made a difference for us. We are definitely a more efficient team because of it.

Ready to future-proof your cash management operations?

Discover why over 1000 finance teams trust AccessPay to automate corporate banking operations.

Complete the form to schedule a free consultation with one of our bank connectivity specialists ➜