Chris Allison

Project Manager, Admiral

We’re looking to move all of our processes to cloud-based solutions by 2025; and AccessPay aligns with our company objectives, plus we don’t have to worry about future transaction fees, it scales with us.

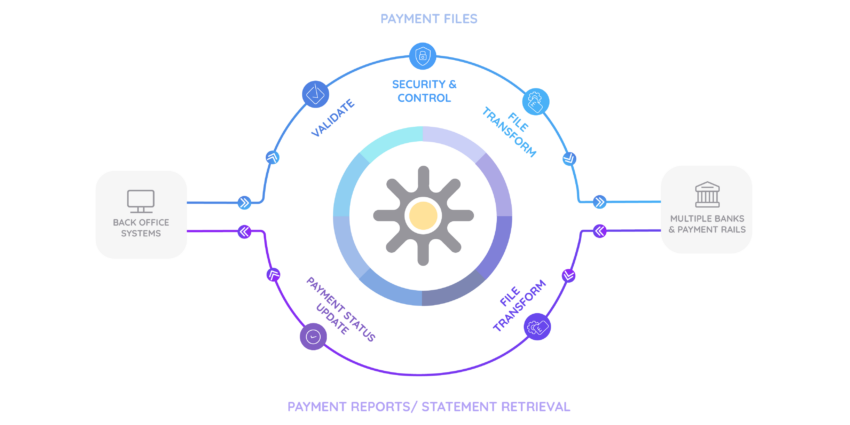

Maximize the ROI of your next finance transformation project by embedding your corporate banking estate within your back-office infrastructure. Minimize time to value and transform the way you work by connecting your financial world with AccessPay.

When modernizing your internal infrastructure, it’s easy to overlook modernizing your connections with banks. This is often the missing piece that is overlooked by finance transformation specialists as many don’t realize it’s actually possible.

Corporate-to-bank integration allows organizations to streamline these connections, allowing for a more efficient payment process. This not only mitigates the risk of fraud and error, but can significantly increase productivity for finance and treasury teams as well.

Most ERPs don’t talk to banks. Those that do offer limited forms of connectivity. Working with AccessPay alleviates any potential pitfalls with your ERP by embedding access to your entire banking estate, as well as connectivity to both domestic and cross-border payment rails.

Banks and payment rails each have different formatting and data requirements. As financial institutions gear up to the industry standardization of payment messages via ISO20022, AccessPay supports both FIs and corporates through this period of transition.

Our file transformation engine automatically exchanges files between your back-office and your banks in the right format.

It’s possible manual processes are still prevalent due to a lack of seamless connectivity with your banks via your ERP. This can increase the risk of fraud, errors and overall inefficiency.

Integrating AccessPay with your banks is necessary to automate traditional manual payment processes giving you a more efficient payment process and greatly reducing the risk of error and fraud associated with manual intervention.

Project Manager, Admiral

We’re looking to move all of our processes to cloud-based solutions by 2025; and AccessPay aligns with our company objectives, plus we don’t have to worry about future transaction fees, it scales with us.

Head of Treasury Operations, ITV

AccessPay helps us achieve visibility across all our regions by linking in all our banks via MT940s, to all of the banks we will send daily statements. From that we can see all of the movements and then group bank accounts by banks or by currency.

Treasury Manager, Willmott Dixon

The thing that keeps me up at night as a Treasury Manager is fraud – both internal and external.

Centralizing disparate systems is a cornerstone of modern finance transformation and technology. By unifying bank connectivity across previously separate systems you can consolidate your banking processes and facilitate better decision-making through improved access to transaction data.

Working from one platform will also improve efficiency across your processes, with less time spent on manual processes and more time to focus on value added tasks.

Standardising payment controls can provide businesses with greater visibility and control. These controls ensure that only authorized payments are executed, payment files have been scanned for potentially fradulent transactions and the approval processes are controlled effecitvely.

Businesses can achieve greater peace of mind knowing payment runs are secure, efficient and compliant, by removing the people and compliance risks associated with manual intervention.

Retrieve bank statements and payment reports in near teal time; improving accuracy, efficiency, and visibility of their financial data. Businesses can also improve their cash management & forecasting, better manage risks and make more informed decisions in today’s financial market.

Gain true finance transformation with seamless bank connectivity; the missing piece in your ERP project

While modern technology is transforming business processes across the board, a disparity still exists between retail banking and corporate banking. Our technology is tailored to address this disparity, seamlessly integrating with the existing ecosystem of your finance function.

This integration acts as a bridge between your back-office systems and banks, making banking operations more efficient and less prone to errors. Moreover, this solution is highly scalable, making it ideal for multi-banked businesses to integrate as many back-office systems and banks as they want to support future growth.

It’s not uncommon for businesses to attempt to resolve their banking challenges in-house. However, such DIY projects can require substantial investments of time and require specialized expertise to maintain effectively. At AccessPay, we understand these challenges and provide an alternative solution which is managed on your behalf.

We work with the world’s biggest banks, ensuring our connections and relationships are tried, tested, and trusted by our clients. Our team is comprised of specialists in banking, finance, and FinTech, who work tirelessly to create innovative solutions for our clients daily. Our mission is to build future-proofed solutions that benefit our clients both now and in the years to come.

We spoke with Barclays and they recommended AccessPay as the preferred solution. We also spoke with other insurance providers, and everybody recommended you, which is highly commendable.

Chris Allison, Project Manager, Admiral