“I would like to specifically acknowledge the expertise and professionalism of the AccessPay team. They played a pivotal role in the successful implementation of AccessPay into business as usual at MHR. Their knowledge, attention to detail, and commitment to delivering a high-quality solution have greatly contributed to the overall success of this initiative.“

Revolutionise the way you make payments on behalf of your clients with our BACS Bureau Software

Payment automation solution for accounting firms, payroll providers, and businesses handling payments on their clients’ behalf.

100% of BACS made on time

Every file uploaded via the AccessPay platform is guaranteed to be transmitted to BACS that day.

We maintain a 100% delivery rate.

That’s why we’re the leading, trusted partner for BACS Bureaus just like you.

Streamline Client Payments with Confidence

Build credibility & trust with your clients

Becoming or working with a BACS-Approved Bureau enhances credibility with your client base, signaling trustworthiness and reliability across your payment processes.

Clients can trust their payments are in safe hands when you’re approved by BACS.

Efficient & secure payment processing

With direct access to BACS, you’ll not only simplify payment procedures but also ensure security, accuracy, and compliance with banking standards, ultimately fostering smoother financial operations.

Automate BACS payments without the risk of error.

Ensure compliance with BACS industry standards

Gaining approval or working with a BACS bureau involves adhering to stringent standards set by BACS. Working with us, you’ll automatically meet these rigorous standards.

Ensure compliance, without the headaches.

Transform the way you make client payments

Streamlined client payment solutions for BACS-Approved Bureaux

AccessPay’s Bureau solution seamlessly integrates with any accounting, payroll or ERP solution and can process any type of payment file format.

Send client payments without the worry of extra transaction fees and upgrade costs whilst you acquire more customers.

Automate client payments without being a BACS-Approved Bureaux

With AccessPay, unlock seamless client payments without the need for your own BACS accreditation.

As a BACS-Approved Bureau, we have the necessary compliance covered, allowing you to focus on delivering exceptional services for your customers.

Revolutionise the way you make payments

on behalf of your clients. Get set up in

as little as 2-4 weeks.

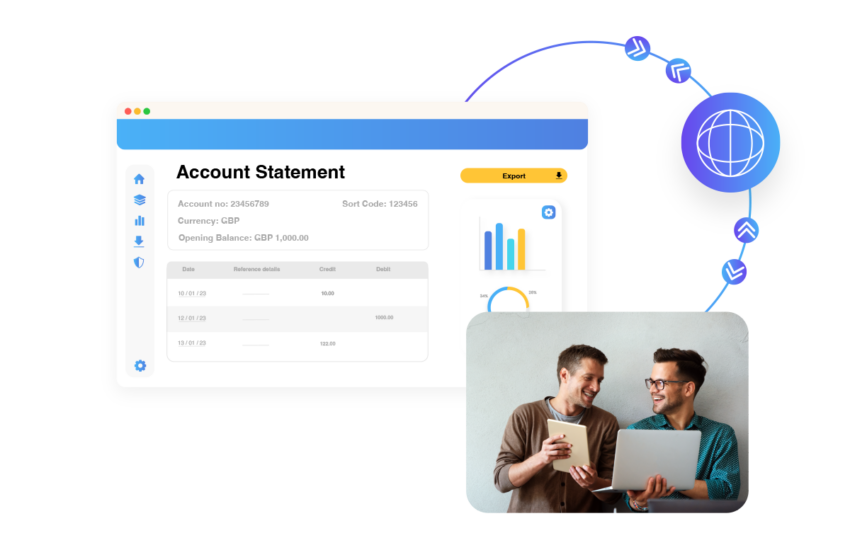

Integrations

AccessPay connects your entire finance ecosystem. Our BACS solution is compatible with all major ERPs, payroll systems and any other application you use to generate payment files.

Unmatched efficiency & compliance guaranteed

100% guaranteed delivery of all payment files

Enhanced payment workflows

Automatically stay compliant with BACS’ stringent regulations

Timely, accurate BACS reports

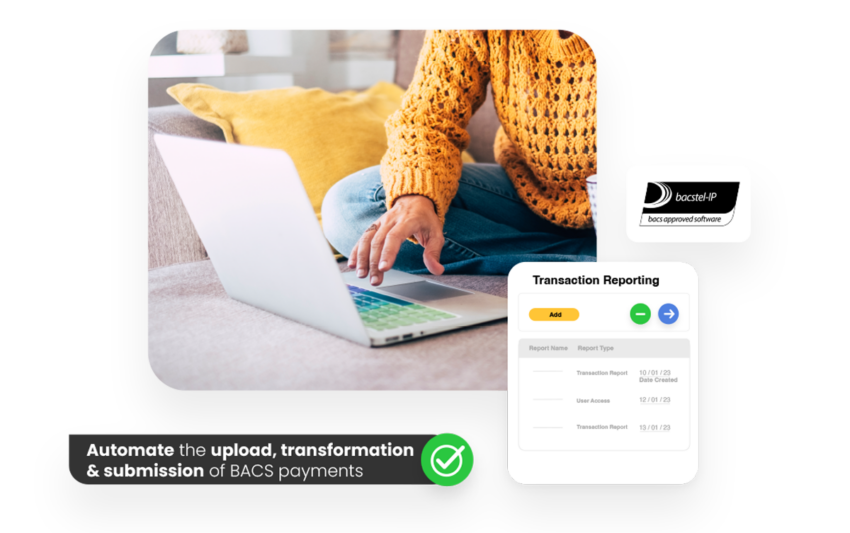

Automate BACS payments

- Enhance payment workflows via automated BACS submissions

- Automate upload, transformation, and submission of BACS payments via sFTP or API for all file formats

- Seamless management of approvals and submissions across diverse teams and systems via customisable workflows

- Early error detection through live submission status alerts for rejected, failed, or cancelled submissions

- Automate BACS report retrievals for instant access to crucial financial information

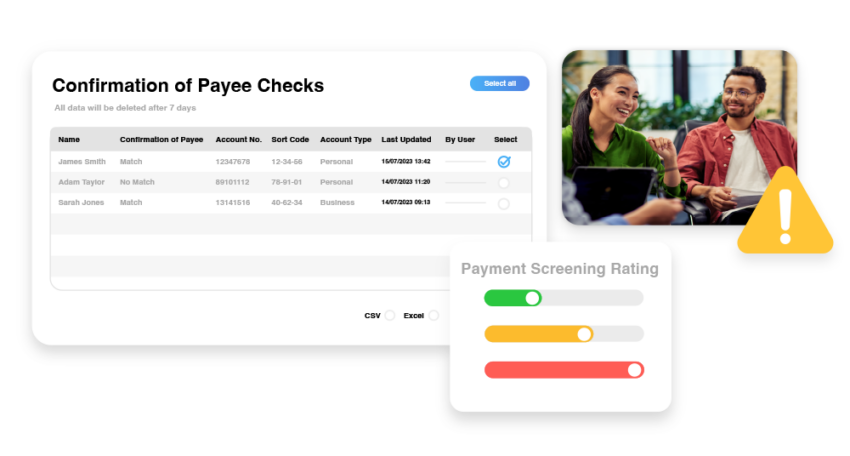

Fraud prevention & enhanced payment controls

- Bank-grade, secure payment controls

- Fraud & Error suite including; Confirmation of Payee (CoP), Sanctions Screening and Payment Screening

- Data masking

- PGP encryption

- Advanced, automated auditing capabilities

- Multi-factor authentication (MFA), powered by Duo

- Custom approval workflows and strict user controls

Partner with the first cloud-native

BACS-approved software provider in the UK and automate your BACS payment

“The AccessPay system works really well for the team here at Argyll and Bute. The way that the system handles security and access is very good. We use it to manage payments and submit files every day, sometimes twice a day.“

Enhanced payment protection for your customers with Confirmation of Payee (CoP)

Conduct name checks for businesses and individuals, ensuring payment information is correct before a payment is made.

Guarantee that payments reach the intended account, effectively avoiding misdirected payments.

Enhance customer confidence and reduce the risk of growing threats like Authorised Push Payment (APP) fraud.

Efficient cross-border transactions via Host-to-Host Connectivity

Are you making payments overseas? Expand your reach with our seamless international payment capabilities.

Handle cross-border transactions effortlessly through Host-to-Host bank-connectivity.

Get set up in as little as 2-4 weeks

AccessPay offers a fast implementation in as little as 2-4 weeks.

Bureaux can effortlessly add their own service users’ numbers (SUNs), facilitating quick execution of payments as soon as bank connectivity is in place.

Transparent pricing model

Our fixed pricing model ensures transparency, protecting you from unexpected costs when exceeding transaction thresholds.

We offer 12-month contract lengths for complete peace of mind.

How does AccessPay work?

Industry-leading service

Leverage industry knowledge for smoother implementation.

All-in-one platform solution

Manage all payment types from a single platform.

Fully automated payments

Streamline payroll, BACS submissions, direct debits, and credits effortlessly.

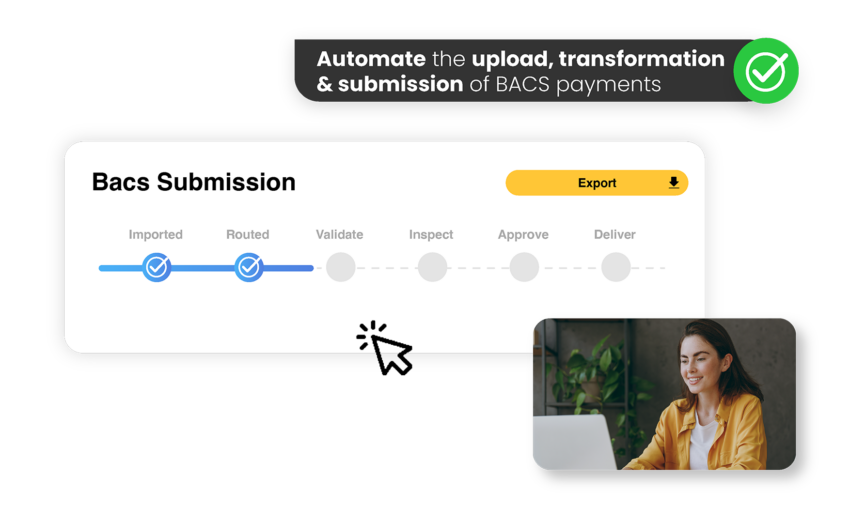

1

Upload your payment run

Automatically import BACS payment files from connected finance applications via SFTP or API connection. Files can also be imported manually as a contingency.

2

Routing and file transformation

AccessPay instantly scans the payment file to recognize the purpose and configuration of your payment run to ensure the file is correctly formatted and passes through the correct submission workflows within AccessPay.

3

Validate your transactions

A modulus check is performed to alert you to errors with the sort codes and account numbers contained within your file. Giving you the opportunity to suppress problem transactions or files before you proceed with your submission.

4

Perform fraud & error checks

A series of configurable rules can be applied to scan your BACS submissions for potentially erroneous transactions. Helping you identify and investigate potential duplicates, unrecognized creditors and exceeded transaction thresholds.

5

Approve your submission

AccessPay is configured to mirror your internal approval processes. Whether you carry out approvals within your finance application or AccessPay, dual approval is available.

6

Authenticate your payment file

The file is digitally signed via a choice of Hardware Security Module (HSM) or Smart Card.

7

Process your submission

The file is ready to be submitted and will be processed via BACS on the date assigned.

✓

Receive BACS Reports

Automatically retrieve BACS reports in to your back-office. See our FAQs for more information.

Ready to exceed customer expectations? Get set up in as little as 2-4 weeks.

Partner with AccessPay now for unmatched reliability, seamless operations, and unparalleled support for your accountancy firm or payroll service.