Protecting your corporate payments from fraud and bolstering cybersecurity seems simple enough.

We’d hope know not to answer any dodgy looking emails featuring Nigerian princes who are just desperate to transfer £100k into your bank account.

As technology marches forwards and online/mobile banking becomes normalised, consumers and businesses become savvier about security than ever before.

So it begs the question: why are we still reading stories about payment nightmares?

The answer, as it turns out, is in human error.

Missing Money Isn’t Always Malicious… But it Can Be

We’re not saying that there aren’t thousands of prospective hackers and fraudsters out there trying to steal your bank details; cyber security is a genuine concern.

In 2020 alone, the value of annual online banking fraud losses in the UK totalled an estimated £159.7 million.

Technological advancement is a double-edged sword, in this sense. As cybersecurity increases and banking fraud solutions increase in ubiquity, so too do the methods of online criminals.

For example, by the end of September, 2021 had already broken the record for the amount of zero-day attacks – dedicated exploits targeted at software weaknesses that are either unknown to the host or known and yet-to-be patched.

Human Error: Worse Than You Think

The thing is, malicious attacks are often the least of a business’s concerns when it comes to cyber security.

True, these days most employees are, at the very least, aware of phishing emails and the importance of 2 factor authentication (if you’re not, find out all about it here).

But despite this, the numbers support a much more worrying, prevalent, and harder to catch issue when it comes to fraud prevention: human error.

You might be asking yourself: how much of a problem is human error, really?

In other sectors, disciplines, and throughout different phenomena, the threat of human error is perhaps more tangible. What if, for example, the vote is miscounted in a crucial election?

Well, human error in payments a bigger issue than you think. In fact, estimates often place human error at the centre of responsibility for as many as 95% of cybersecurity breaches.

It can be as easy misplacing a decimal point in your corporate payment, accidentally typing an extra zero, or misremembering your workflow and sending a payment twice.

The main thing to remember is that it is completely avoidable when you have the right processes in place supported by the right software.

A lack of payment fraud management can cause needless stress – and no one likes that.

Internal Mistakes Can Cause Chaos

Imagine you’re a teacher. You’ve got kids to feed and bills to pay. Perhaps it’s your son’s birthday at the end of the month, and you can’t wait to buy him that PlayStation 5 he’s been asking for.

It’s payday. On your way into work, you check your salary via online banking. To your horror…not only have you not been paid, but your account status is sat way into the overdraft.

What? Your heart starts to beat. You check again. The numbers haven’t changed.

You think to yourself: this can’t be right. Unfortunately, it is.

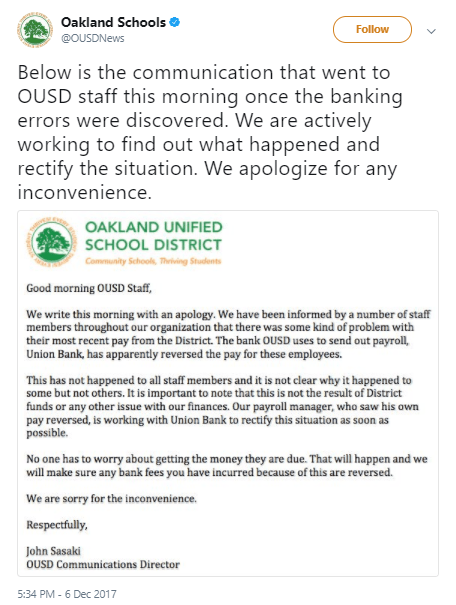

That’s exactly what happened to teachers in the Oakland School District back in December 2017.

Luckily, the mistake was rectified fairly quickly after being discovered at 9.30am. But that didn’t really help placate the teachers, when their pay checks ended up getting reversed, instead of paid in.

Now, I don’t know about you, but taking money from staff when they’re expecting a full month’s wage doesn’t sound good for internal morale to me.

And do you really think the affected staff were focused on teaching that day? Or were they too worried about the payment fiasco going on behind the scenes? I’d presume the latter.

Things got worse in Oakland after it was revealed that the embarrassing mistake was all down to human error by an undisclosed employee. It may have been fixed, but staff trust was completely gone.

Obviously we can’t say for sure in this situation, but payment errors and stresses are a leading cause of mental health problems and burnout.

What Can Be Done to Prevent Human Error in Payments?

There are lots of ways to avoid human error in corporate payments within the AccessPay platform, and one thing we recommend to all of our clients is segregation of duties.

Segregation of duties is an additional step in payment processing, and it involves the approval of payment files by more than one person before they are finalised.

Ever hear that two heads are better than one? Segregation of duties is a sure way to prevent a mistake from seriously irritating your staff due to problems with payroll, bolstering cybersecurity even before banking fraud solutions are introduced.

In the Oakland School District example above, having more than one employee reviewing the payroll documents could have stopped a huge headache for those poor teachers, as well as avoiding a whole lot of embarrassment, distress and bad PR for the schools involved.

As technology develops, it becomes easier for one person to take on several tasks. But this doesn’t always save time. Skipping vital internal controls can mean serious oversights fall on the head of one potentially oblivious employee, simply because they didn’t check every file diligently enough.

No matter the size of a company, all can benefit from the extra layer of security that segregation of duties brings. All it involves is the introduction of the appropriate checks, associated privileges and signs offs.

It’s a simple idea, but it’s key to protecting your business payments from human error, and those costly mistakes that no one wants to happen.

Want to know more?

Payment nightmares and cybersecurity issues like the one mentioned above can be easily avoided with a reliable payment software such as AccessPay, as corporates are increasingly turning to FinTech for a variety of solutions. But they still happen. Don’t just take our word for it.

Browse through our security & fraud prevention page to find out about segregation of duties within the Detect module.

Alternatively, why not check out our recent Platform Showcase? You’ll get a closer look at how AccessPay’s payment and cash management automation can streamline your workflow and increase security.