"The AA has a significant volume of transactions; a large amount of money is being handled. We felt that having a partner we can trust, but that can move quickly and keep us up to speed with new developments, was essential."

BACS-Approved Software, trusted by over 1,000 organisations

Centralise & de-risk your BACS submissions by partnering with

the first cloud-native BACS-approved software provider in the UK.

Clients we’ve helped with

our BACS-approved software

Get in touch and see how we can help centralise and de-risk your BACS submissions as the first cloud-native BACS-approved software provider in the UK.

Why AccessPay

Transparent pricing

Benefit from a fixed annual subscription model to avoid getting stung by hidden costs and support easier forecast expenditure.

Industry-leading service

We’re proud to offer rapid onboarding and unrivalled support from our UK-based Customer Success team. In fact, we have a customer satisfaction score of 100%.

One platform for all payment types

Process more payment types than just BACS? AccessPay works with those, too. Meaning one supplier, and one set of payment controls, for all your business payments.

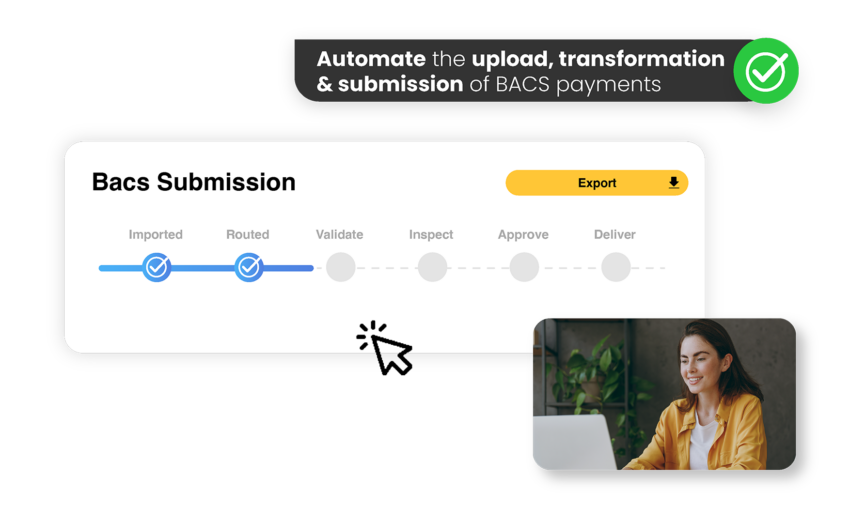

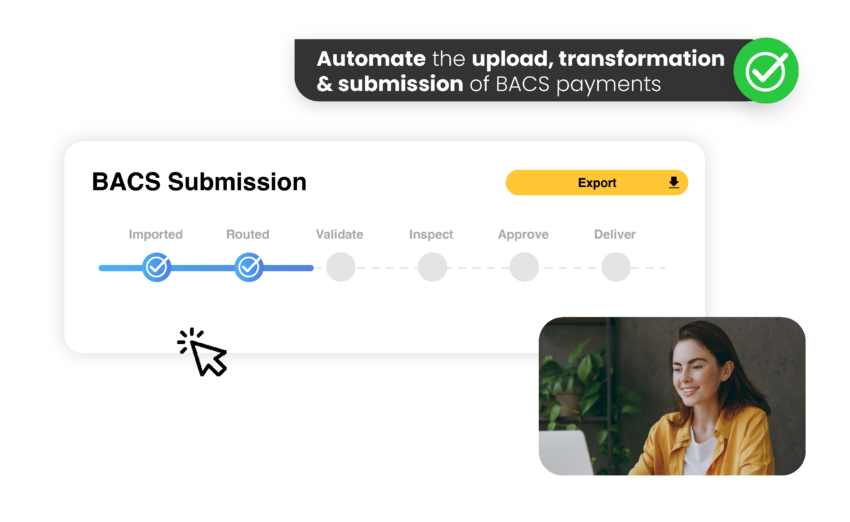

Automate BACS Payment Submissions

- Create more efficient and secure payment workflows through the automation of BACS submissions.

- Our technology is compatible with all file formats to automate the upload, transformation and submission of BACS payments via SFTP or API connection.

- Manage approvals and submissions across different teams and systems with customisable workflows

- Detect errors early with live submission status, alerting you when submissions have been rejected, failed, or cancelled.

- Automate BACS report retrievals to gain access to the information you need, when you need it

Stay secure with enhanced payment controls

Effective payment controls are crucial to risk reduction and governance within the finance function. AccessPay helps you secure your payment operations by providing:

- Encryption and masking of all payment data

- User access management controls such as MFA & SSO

- Strict segregation of duties between users

- Automatable fraud and error checks on payment files

- Native Confirmation of Payee checks on beneficiary data

- Dual approval capabilities

Explore our use cases

Ready to centralise & de-risk your BACS submissions? Get up and running

in as little as 12 weeks.

Get in touch with one of our experts by completing our contact form.

Integrations

AccessPay connects your entire finance ecosystem. Our BACS solution is compatible with all major ERPs, payroll systems and any other application you use to generate payment files.

BACS software pricing

Choose the UK’s first cloud-native BACS-Approved Software Provider. Secure, automated, flexible.

Our solutions are tailored to our customers’ needs, and our pricing depends on factors such as embedded security measures, workflows and level of automation. If you’re interested in exploring whether AccessPay may be a fit as your BACS software, please get in touch with us.

SMB

Starting at

£2,500.00

(£203.33/month)

Fixed annual subscription

- Modulus Checks

- Automated Approval Workflows

- Segregation of Duties

Corporate

Starting at

£5,500.00

(£458.33/month)

Fixed annual subscription

- Authentication via HSM or Smart Card

- Modulus Checks

- Automated BACS Reports

- Automated Approval Workflows

- Segregation of Duties

- Dedicated Customer Success Manager

Enterprise

Contact

Sales

for a bespoke, Enterprise-ready solution

- Authentication via HSM or Smart Card

- Modulus Checks

- Automated BACS Reports

- Automated Approval Workflows

- Segregation of Duties

- Dedicated Customer Success Manager

Helping The AA keep 14 million members moving

Keeping the show on the road, The AA process weekly and monthly payroll, as well as collect millions of monthly direct debits for membership fees, through AccessPay.

This means all 7,300 staff are paid on time as the finance team submit BACS files via the cloud-based platform.

With two banks connected, AccessPay provides The AA with a file agnostic solution which takes files from their ERP systems and submits them to BACS. This process automation has helped the motoring giant; who has been at the nation’s side for over a century, to provide drivers with a trusted membership to cover breakdown assistance, car insurance and more.

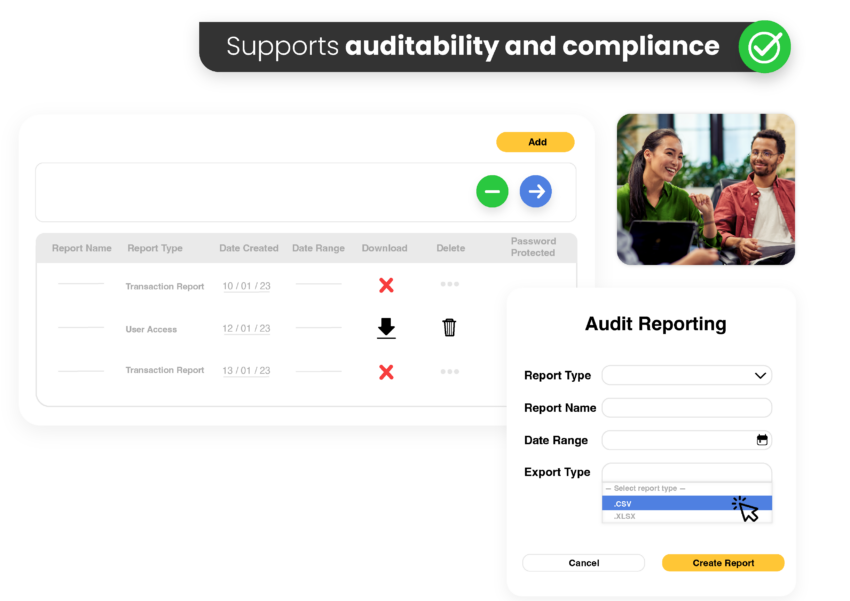

Support governance and compliance

Every action taken within AccessPay is automatically recorded and can be easily exported to help you provide evidence during internal or external audits.

Match the way you currently work

Whether you’re processing Accounts Payable, Payroll or Direct Debit collections through BACS, we will configure your solution to match your internal processes.

Meaning you don’t need to change the way you work to meet the restrictions of the software you use. Instead, your BACS software works with you.

Partner with the first cloud-native

BACS-approved software provider in the UK.

Get in touch with one of our experts by completing our contact form.

How does AccessPay work?

1

Automate your payment run

Automatically import BACS payment files from connected finance applications via SFTP or API connection. Files can also be imported manually as a contingency.

2

Routing and file transformation

AccessPay instantly scans the payment file to recognize the purpose and configuration of your payment run to ensure the file is correctly formatted and passes through the correct submission workflows within AccessPay.

3

Validate your transactions

A modulus check is performed to alert you to errors with the sort codes and account numbers contained within your file. Giving you the opportunity to suppress problem transactions or files before you proceed with your submission.

4

Perform fraud & error checks

A series of configurable rules can be applied to scan your BACS submissions for potentially erroneous transactions. Helping you identify and investigate potential duplicates, unrecognised creditors and exceeded transaction thresholds.

5

Approve your submission

AccessPay is configured to mirror your internal approval processes. Whether you carry out approvals within your finance application or AccessPay, dual approval is available.

6

Authenticate your payment file

The file is digitally signed via a choice of Hardware Security Module (HSM) or Smart Card.

7

Process your submission

The file is ready to be submitted and will be processed via BACS on the date assigned.

✓

Receive BACS Reports

Automatically retrieve BACS reports in to your back-office. See our FAQs for more information.

Automating Payments with Admiral Insurance to Scale with Future Growth

Admiral Insurance are one of the leading FTSE100 Financial Services companies within the UK, Europe and America; they are also leading the charge when it comes to digital transformation as they aim to be fully ‘cloud-based’ by 2025.

AccessPay now plays a pivotal role in this strategy through automation and management of their payment processes; improving efficiency and reducing risk and fraud from unnecessary, manual intervention.

"We’re looking to move all of our processes to cloud-based solutions by 2025; and AccessPay aligns with our company objectives, plus we don’t have to worry about future transaction fees, it scales with us."

FAQs

What prerequisites are needed for working with AccessPay?

To submit BACS payments through AccessPay, you must have sponsorship from your bank in the form of a Service User Number (SUN). You can find more information on Service User Numbers here.

How does the AccessPay pricing model work?

At AccessPay, we’ll never charge per transaction. Instead, we offer a fixed annual subscription model, which means you’re not penalized for exceeding predicted transaction volumes during your contract with us.

Pricing is calculated based on 3 factors and is only ever reviewed upon contract renewal:

- Estimated transaction bandings

- The number of systems you want to connect to

- The number of payment configurations and submission workflows you require

A one-time implementation fee of 20% will be applied when you first sign up with us.

How quickly can AccessPay be implemented?

You’ll be able to begin processing BACS payments within 8 weeks from the moment you sign up with us.

Is AccessPay a cloud-based solution?

Yes, AccessPay is a cloud-native solution – we were the first vendor to launch a cloud-based BACS solution in 2012. Therefore, in order to leverage AccessPay, all you require is an internet connection.

Which finance applications does AccessPay integrate with?

AccessPay integrates with any application capable of generating a payment file. We’re able to connect to cloud-based applications via SFTP or API, and to on-premise solutions via SFTP.

Which file formats is AccessPay compatible with?

- Pain.001 v3 (CGI-MP)

- Pain.008 v2

- Pacs.008

- DSV (Delimiter Separated Variable file)

- Fixed width

- Standard 18

- DTA & PF-DTA

Which BACS reports can AccessPay receive?

- arudd

- arucs

- auddis

- auddisarrival

- auddisinput

- auddiswithdrawal

- auddisinputtest

- auddisfileacceptance

- auddisfilerejection

- auddissubmission

- compliancehistory

- addaccs

- awac

What is the difference between a Smart Card and a Hardware Security Module (HSM)?

Using Smart Cards requires access to a physical device, called a smart card reader and requires access to third party software (Gemalto) to sign your submission.

A Hardware Security Module (HSM) is a digital form of authentication which does not require access to hardware. HSMs can be configured as either:

- Attended – requires authentication by an approved user

- Unattended – authentication is fully automated to enable straight through processing of BACS submissions.

Is AccessPay secure?

Yes, we’re a BACS-approved, FCA-registered vendor and we carry out regular security testing with 3rd party vendors, including:

- Regular penetration tests

- Cyber Essentials Plus certification

- Compliance with information security and business continuity ISO standards

Ready to explore how AccessPay can help your business?

If you’re looking for support with your next bank integration project, you’ve come to the right place.

Complete the form to schedule a free consultation with one of our bank connectivity specialists.

Speak to our team ➜