When it comes to BACS, businesses often have a lot of questions: what is BACS? How do you make a BACS payment? How long does a BACS payment take? What does BACS stand for?

It’s natural to have these questions – the world of banking is a confusing one. Rest easy, we’re here to help.

Quite simply, BACS is by far the most popular method for sending and receiving business payments in the UK.

Having processed “more transactions than the total number of people to have ever walked the earth”, in the world of electronic banking transfers, BACS software reigns supreme.

Continuing to dominate the UK banking industry even after half a century, it is understandable why the word BACS has become synonymous with payments in the United Kingdom. Like the brand name Hoover, both consumers and businesses commonly refer to sending or receiving electronic payments as “making a BACS payment”.

However, the term BACS, (Bankers’ Automated Clearing Service) actually refers to the central payment network owned and operated by the 16 major UK Clearing Banks and building societies that make up the membership organisation, rather than the payment itself.

Let’s Start Simple- What is BACS?

BACS services are most often used to pay wages, salaries, and state benefits – as well as being the preferred payment system for pensions, employee expenses, insurance settlements, and tax credits.

BACS transfers allow you to make regular payments on a date of your choice, making it both flexible and cost effective with the price typically averaging at around 23p per transaction.

BACS transfers allow you to make regular payments on a date of your choice, making it both flexible and cost effective with the price typically averaging at around 23p per transaction.

In 2017, over 6 billion UK payments were made through BACS payment systems, with a combined value of roughly £5 trillion.

There are two types of UK business payments that can be completed with the BACS payment system. These are BACS Direct Credit and Direct Debit.

BACS Direct Credit

BACS Direct Credit is a practical option for organisations of all sizes for electronically sending or receiving payments quickly and efficiently into a bank or building society account.

Predominantly used by UK employers for paying wages and salaries, today BACS Direct Credit handles transactions by businesses of all sizes for a variety of purposes, including, but not limited to:

- Pension payments

- Paying employee expenses

- Settling insurance payments

- Disbursing shareholder dividends

- Issuing refunds

BACS Direct Credit entails several benefits, these being:

Time efficient –

BACS Direct Credit is simple to prepare and quick to process, especially when compared to traditional payment methods such as cash and cheques.

Cash-flow control –

A regular and fixed BACS Direct Credit payment schedule allows for greater transparency and month-on-month forecasting.

Cost saving –

BACS Direct Credit significantly reduces risk and security costs associated with cash handling, and directly saves on the cost of administration and postage when sending out cheques.

Difference between BACS and CHAPS

CHAPS (Clearing House Automated Payment System) is another payment scheme that occurs through bank transfer.

The most important differences between CHAPS and a BACS payment is the cost of the service and the time it takes for the money to be transferred. Unlike BACS payment schemes, CHAPS guarantee same-day payment if the instructions are sent before the banks deadline, generally between 2-3pm on a working day.

There is no limit to the amount of money you can send, however CHAPS comes with a high charge for their service, between £25-35 depending on the bank.

This means it is best for one off high payments, whereas BACS is a possibility for long term payment instalments with a significantly lower cost per transfer.

How Long Does a BACS Payment Take?

A common question within this topic is how long a BACS transfer takes.

Payment by BACS – both Direct Credit and Direct Debit payments – take three working days to clear.

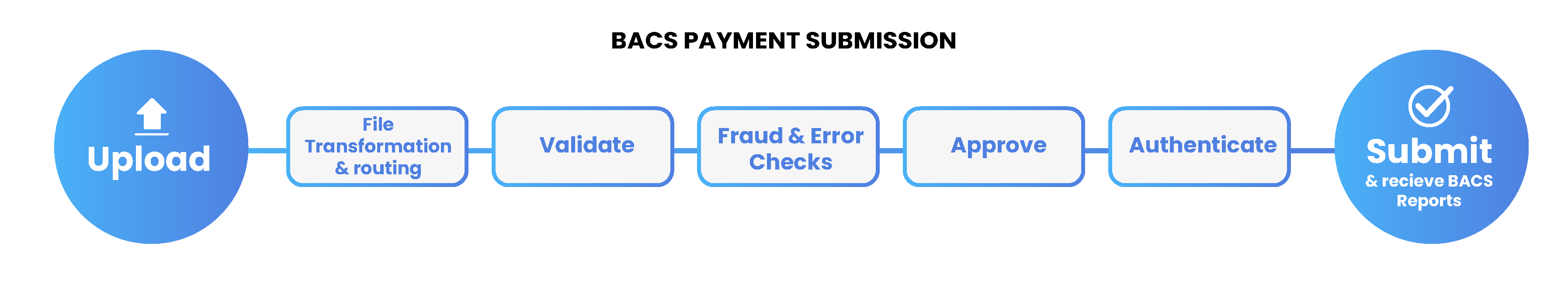

The process begins with the payment being submitted to the BACS system on the first day, with the second day then dedicated to them being processed by the bank. The third day consists of money being simultaneously taken from the sender account and credited to the recipient.

Due to this process taking only three days, BACS payment time is fast and is a practical option for organisations hoping to send and receive payments quickly and efficiently.

How to Make a Payment

So, how to make a BACS payment – it’s likely the next thought on your mind.

When it comes to the matter of how to make a BACS payment, there are two methods: Direct Credit and Direct Debit.

Both of these options require you to know information about the participating account to complete the payment. To pay by BACS, the required information is: the name of their bank, the account number, and the sort code.

If you want to take payments, then Direct Debit may be the top choice for you. BACS Direct Debit is an instruction from a customer to their bank which authorises an organisation to take payments from their account, as long as the customer gives notice of the payments and dates to their bank. This is the safest way of making payments in the UK as there is a guarantee meaning customers are protected from any fraudulent payments.

Direct Debit is typically used for taking regular payments such as household bills, subscriptions, memberships, and so on.

It can, however, also be used for one off payments. Direct Credit, as previously explained, is a secure service allowing organisations to transfer or receive payments directly into another account. This service enables business to transfer money securely and simply, without the high costs that can be associated with traditional method of payment processing.

BACS Software

The BACS Approved Software Service (BASS) consists of a rigorous testing process that allows software suppliers to be approved and accredited by BACS.

Once approved, it allows companies who go through the process to connect to the Bacstel-IP network, this being a delivery channel which gives corporate users secure online access to BACS.

All Bacstel-IP software is approved by BACS before reaching the marketplace, meaning users can be reassured that the software has surpassed all of the set quality standards, reducing any chance of payment errors and enhancing control and protection of BACS submission.

Learn more about how BACS Approved Software could benefit your business

Considering an alternative to your legacy BACS payment solution?

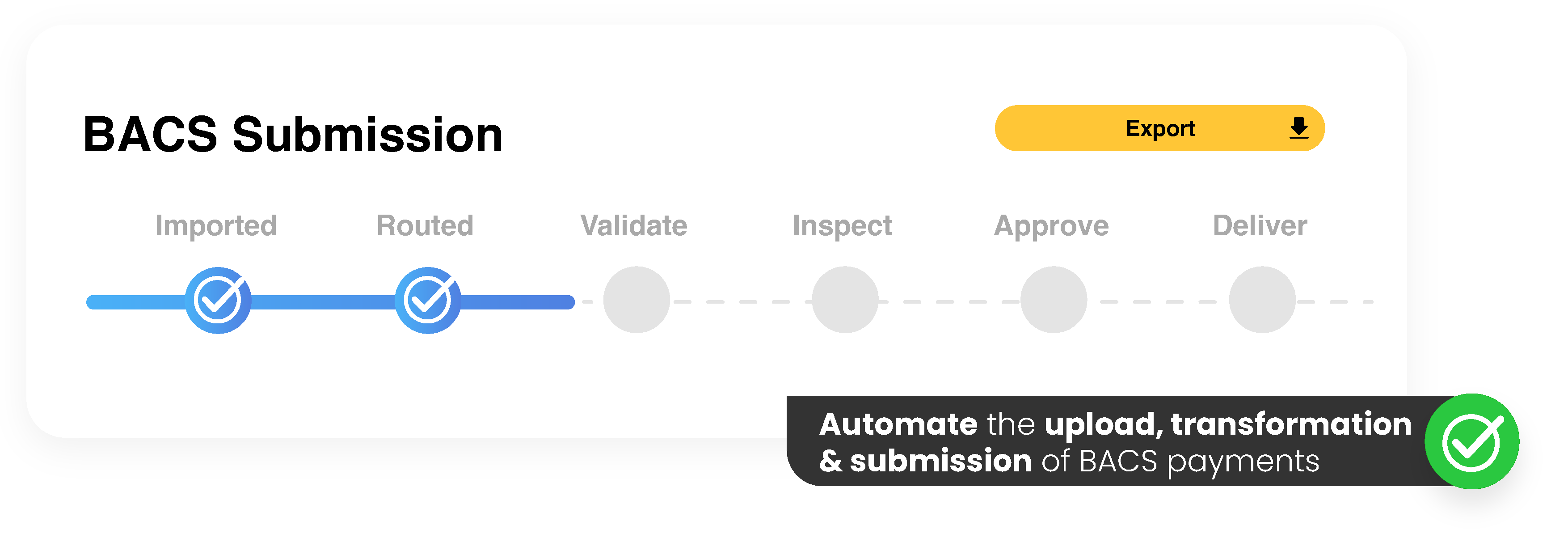

Here at AccessPay, we recognise the value of BACS – in fact, we help thousands of businesses to automate their BACS payments.

Considering an alternative to your legacy BACS payment solution?

AccessPay is the first cloud-native BACS-Approved Software provider in the UK and the most scalable alternative to your current BACS payment provider.

If you want to automate direct debit payments and credit collections without expensive transaction fees and lengthy contacts, AccessPay is your answer.

Want to find out more? Speak to one of our team today.